MBA Graduate vs CA Professional: A Day in the Life

A 2025 guide comparing MBA and CA careers — covering course duration, fees, salary, difficulty, and career scope. Written by Hitesha Patil for Only Education, it helps students choose between business management and chartered accountancy.

MBA Graduate vs CA Professional: A Day in the Life

Choosing the right career path is an important decision that can influence your professional life and future success. Among popular options in business and finance, Chartered Accountancy (CA) and Master of Business Administration (MBA) are two recognized qualifications that differ in many ways. CA provides in-depth knowledge of accounting, auditing, and taxation. In contrast, an MBA allows for a wider range of management, leadership, and strategic roles in various industries. This article compares MBA and CA in 2026. It looks at the main differences, career opportunities, skills gained, and which option might fit your goals and strengths best. Whether you want specialized financial skills or broad business leadership, knowing these career paths will help you make a smart and fulfilling choice.

Introduction -

MBA, or Master of Business Administration, is a respected graduate degree for business professionals who want to gain knowledge in management, strategy, and leadership. This program gives students a wide range of skills in areas like finance, marketing, operations, and organizational behavior. It prepares them for different roles in the corporate world and other fields. Universities and business schools usually offer an MBA. Students can choose from various formats. These include full-time, part-time, online, or executive programs. This variety makes it a flexible option for both recent graduates and working professionals.

CA, which stands for Chartered Accountant, is a well-known professional title for experts in accounting, auditing, and taxation. Chartered Accountants go through strict education and training.. Professional bodies like ICAI in India award the CA qualification. Those who earn it are respected for their analytical skills, attention to detail, and their ability to give strategic financial advice.

Why this comparison is relevant today

This comparison between MBA and CA matters today because both qualifications provide important opportunities. The job market, skill needs, and industry trends are changing quickly in 2025. The growth of technology, data-driven decisions, global business growth, and more complex regulations have opened new paths for MBAs and CAs. It is essential for those interested to know which route fits their career goals and strengths best. Moreover, the changing expectations of employers and the international opportunities available with both degrees highlight the need for an informed and timely comparison between MBA and CA today.

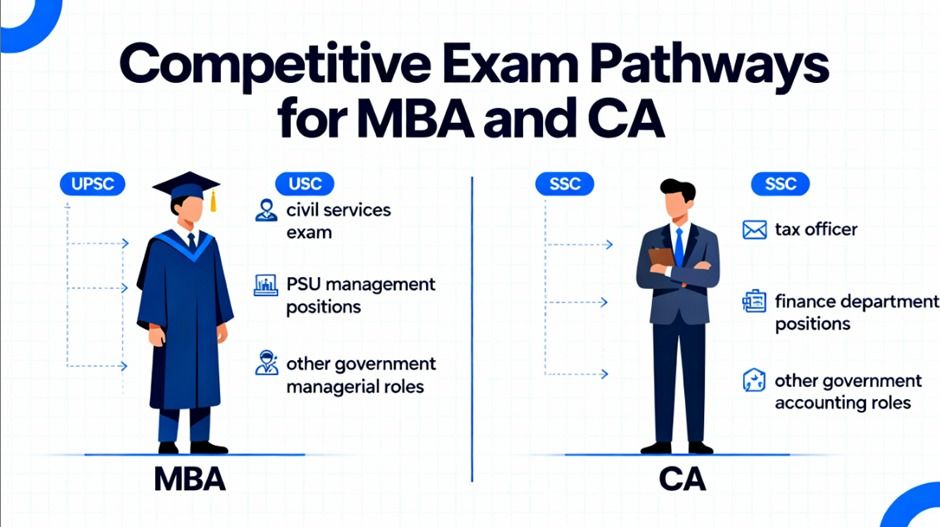

Entry Process — How to Get Into Each Path

| Aspect | MBA | CA |

|---|---|---|

| Entry Exam | CAT, XAT, NMAT, CMAT, GMAT, MAT | CA Foundation, CA Intermediate, CA Final |

| Competition Level | Depends on the college tier | Very high (Low pass percentage) |

| Attempts Allowed | Multiple attempts | Unlimited, but time-bound |

MBA: Admission to top colleges like IIMs, XLRI, and NMIMS requires clearing competitive entrance exams that test logical, verbal, and quantitative skills.

CA: Managed by ICAI, it involves three levels — Foundation, Intermediate, and Final — with a mandatory articleship for practical training.

Course Overview & Duration

- MBA – Quick & Structured:

MBA programs are typically 2 years long, offering a structured curriculum with case studies, group projects, and internships. It’s ideal for students who want fast-tracked professional growth and exposure to management roles across industries. - CA – Long & Intensive:

CA usually takes 4 to 5+ years, depending on the number of attempts. It combines theory and practice, covering taxation, corporate laws, auditing, and financial management. The articled training makes it both a professional and academic journey.

Career Path & Growth Opportunities

Career Growth After MBA:

MBA graduates usually enter corporate or startup ecosystems in areas like marketing, HR, operations, finance, or analytics.

Typical Career Ladder:

Management Trainee → Team Leader → Manager → Senior Manager → Vice President → CEO

1) Fast career growth for those good at leadership and communication.

2) Flexibility to switch industries.

3) Easier to start your own business.

Career Growth After CA:

CAs often begin in audit or accounting firms, corporate finance roles, or as independent practitioners.

Typical Career Ladder:

Article Assistant → Senior Accountant → Audit/Tax Manager → CFO / Partner

1)Greater stability and respect in finance fields.

2) Limited but deep career specialization.

3) Option to start your own firm post-experience.

Cost of Education and ROI

| Expense Type | MBA (India) | MBA (Abroad) | CA |

|---|---|---|---|

| Entrance Coaching | ₹30,000 – ₹60,000 | — | ₹20,000 – ₹40,000 |

| Course Fees | ₹8–25 Lakhs (Top Colleges) | ₹40L–₹1Cr | ₹3–4 Lakhs Total |

| Living/Hostel | ₹2–3 Lakhs | ₹10–15 Lakhs | Minimal (study from home) |

MBA ROI: Highly dependent on college ranking — top IIMs or global B-schools yield strong returns within 2–3 years.

CA ROI: Low investment, high stability, and lifelong professional credibility.

Salary Comparison

| Qualification | Average Starting Salary | Top Salary (with Experience) |

|---|---|---|

| MBA (Tier-1) | ₹18–25 LPA | ₹40–60+ LPA |

| MBA (Tier-2) | ₹5–8 LPA | ₹15–20 LPA |

| CA (Fresher) | ₹8–12 LPA | ₹20–30 LPA |

| CA (Own Practice) | ₹5–8 LPA (start) | ₹50 LPA+ (with clients) |

MBA brings versatility, while CA ensures specialization. The choice depends on whether you want to lead teams or balance sheets.

Impact of AI and Future Demand

Automation is changing both careers:

- CA roles in manual accounting and data entry are being replaced by AI tools like Tally, QuickBooks, and Zoho Books. However, judgment-based auditing, advisory, and compliance roles will remain in high demand.

- MBA roles in marketing, HR, and sales are also evolving with AI-driven decision tools. But leadership, creativity, and emotional intelligence will continue to define value.

Both careers are future-proof if professionals adapt to technology — CAs by learning data analytics and ERP, MBAs by mastering AI-driven management tools.

Colleges & Coaching Resources

Top MBA Colleges in India:

- IIM Ahmedabad, Bangalore, Calcutta

- XLRI Jamshedpur, SPJIMR, MDI Gurgaon, NMIMS Mumbai

- FMS Delhi, JBIMS Mumbai, TISS Mumbai (high ROI)

- Tier-2 options like Christ University, Welingkar, PUMBA

Conclusion

At the end of the day, choosing between MBA and CA isn’t just about money, prestige, or what others expect from you — it’s about who you are and what kind of work makes you feel alive.

If you’re someone who enjoys talking to people, leading teams, solving business problems, and exploring new ideas, then an MBA might be your natural fit. It’s for those who thrive in dynamic, fast-paced environments and want to see themselves grow as leaders or entrepreneurs.

But if you’re someone who finds satisfaction in accuracy, logic, and financial problem-solving, and you don’t mind spending long hours perfecting your craft, then CA could be your path. It’s for those who value stability, structure, and deep expertise in finance and accounting.

Both journeys are demanding in their own ways — the MBA pushes you to be creative and adaptive, while CA tests your patience, consistency, and precision. Neither is easy, and neither guarantees success on its own.

Because ultimately, success doesn’t come from a degree — it comes from clarity.

Clarity about who you are, what you love doing, and how far you’re willing to go to make it happen.

For more detailed university and course guidance, visit:

https://www.onlyeducation.in/university-list/management